The Unilever (LSE:ULVR) share price is up 7% after the company’s latest earnings report. The results don’t look much at face value, but context is everything with this business.

Revenues grew 2.2% during the second quarter of 2024, with net profits up by 3.5%. That’s barely beating inflation, but there’s much more to the story than this.

Looking at the details

Unilever’s a company in transition. It’s attempting to boost its overall growth rate by getting rid of some of its underperforming brands.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

The 2.2% revenue growth doesn’t factor in the company’s sold off some of its weaker lines in the past year. Adding that, revenue growth’s more like 3.9%.

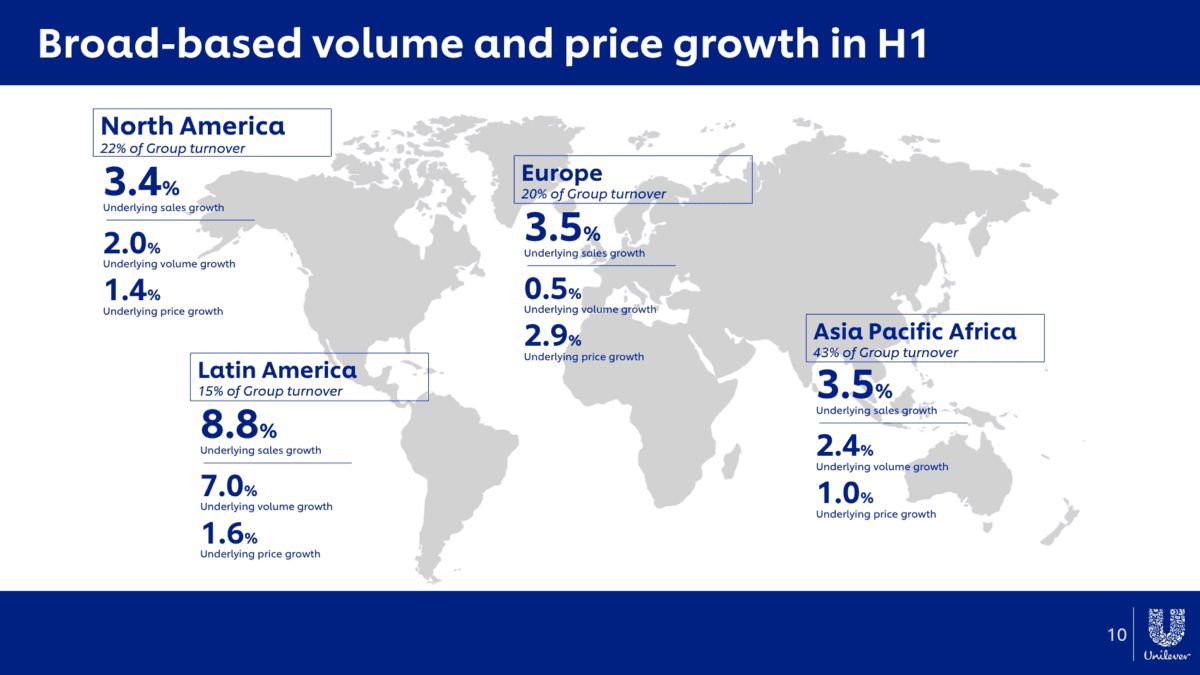

There’s another part of the report I think’s especially encouraging. Unilever announced underlying sales growth of 8.8% in Latin America and 3.4% in North America.

Source: Unilever H2 Earnings Presentation

Latin America’s been a problem for Diageo lately and US consumer demand’s been tough for a number of companies. So a strong performance there’s an impressive result from Unilever.

Ice cream

The weak point in the report is – again – the company’s ice cream division. Despite having some of the strongest brands in the world, the unit reported underlying sales growth of 0.6%.

Unilever’s making progress towards divesting its ice cream operations, so weakness there’s probably less of an issue than in a different area. But the underperformance is still noteworthy.

I’ve heard it suggested that the company’s looking to dispose of its ice cream brands because of the emergence of GLP-1 drugs in the US. But I don’t think that’s quite right.

As I see it, it’s due to slow growth (and the product being expensive to make and ship). But Unilever attributed this to weak demand from Europe and China, not the US.

Turnaround on track

The latest set of results shouldn’t come as a huge surprise to investors. A trading update three months ago reported on the first quarter of 2024 and the half-year results also include this.

Underlying sales growth of 3.9% for the second quarter represent a slight decline from the first three months of the year. But given the underperformance in ice cream, I don’t see an issue here.

Where I do see an issue though, is the share price. A 23% increase since the start of the year puts Unilever shares at a price-to-earnings (P/E) ratio of around 20.

I think the restructuring is going well and the company’s positioning itself well. But a good outcome looks to be factored in at today’s prices, which means there’s risk if anything goes wrong.

One to watch

Unilever shares are racing higher as the restructuring takes shape. And I think investors are right to be optimistic.

Strong results at a time when others are struggling might be causing the share price to get ahead of itself though. That’s why I’m keeping an eye on the stock, rather than buying it.